National Get Outside Day: Provision of Outdoor Retail & Leisure Facilities

27th September 2023

What is National Get Outside Day?

Sunday 24th September marked 2023’s National Get Outside Day, with this year’s theme being ‘Precious Places’. The UK’s precious places: Areas of Outstanding National Beauty (AONBs), National Scenic Areas (NSAs) and National Parks collectively cover ~25% of its land area, offering incredible adventurous opportunities nationwide . The UK’s outdoor scene is world famous in many respects, ranging from the Lake District, a UNESCO world heritage site famed for its hiking and climbing, to the Jurassic Coast, another UNESCO world heritage site, home to a range of fossils found nowhere else on Earth. We have great reason to enjoy and preserve our Great British outdoors.

Outdoor activity is a shared passion amongst the GMAP team, having completed the Yorkshire 3 Peaks Challenge in Summer 2022, and others being keen hikers, cyclists and sailors in our spare time. By applying our location intelligence data, software, and tools, we established the UK’s trends and opportunities in outdoor equipment and leisure facilities markets using our products RetailVision and LeisureVision. In this blog we will explore whereabouts the hotspots and gaps in the UK’s outdoor equipment and activity provision are.

Figures 1.1 - 1.3: Members of our GMAP Team enjoying the great outdoors

Provision of Outdoor Equipment Retailers

Before venturing into the outdoors on any kind of adventures, it is important to be fully equipped. Fortunately, the UK is well-served by a diverse and expanding outdoor sports market, forecasted

to grow annually ~3%

between 2023 and 2027, permitting a greater variety of outdoor activities and numbers of participants. However, surprising gaps and trends were revealed in a preliminary analysis conducted using RetailVision

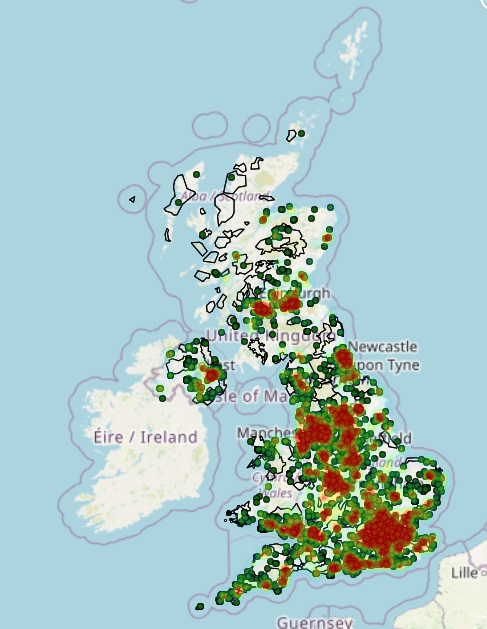

and visualized with our bespoke mapping software MVPLUS.

Outside of London, the greatest concentrations of outdoor equipment outlets were in cities surrounding the Peak District; namely Leeds, Manchester and Sheffield. Edinburgh, Glasgow, Newcastle and Cardiff also are notable though unsurprising hotspots. Amongst the outdoor equipment hotspots included Keswick, Fort William, and Llanberis, famed as the UK’s adventure towns, with small permanent populations yet disproportionately great outdoor offerings. Outside large settlements, coastal towns had greater outdoor equipment provision, perhaps due to the sea’s enablement of a wider range of outdoor activities.

Gaps in the UK’s outdoor equipment market were also revealed, notably in Northwest Scotland and Central Wales. These are likely due to their low permanent populations, and smaller seasonal population influxes relative to the more famed adventure towns. However Central Wales is within touching distance of several ‘Precious Places’ and Northwest Scotland is peppered with them, both presenting potentially viable locations for future Outdoor Equipment outlets. Combining our retail and geodemographic datasets with our expert location planning consultancy, we will guide your next venture into the UK’s thriving outdoor equipment market.

RetailVision

is our product consisting of UK-wide retail outlet locations of over 80,000 stores and covering over 800 brands across 27 categories. Further segmentation by pricing enables comparative evaluation across regions on both the quantity and quality of retail provision. The aggregated RetailVision, RetailVision Destinations, contains identical attributes in a hierarchical format, providing ideal high-level guidance for retail network planning.

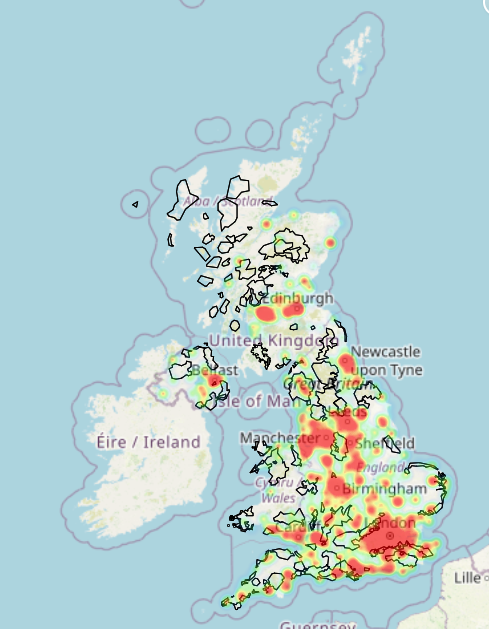

Figure 2: MVPLUS Map of UK Outdoor Equipment Retail Outlets (Heat Map) compared to AONBs (Polygons)

Provision of Outdoor Leisure Facilities

The UK’s outdoor leisure industry has exploded in recent decades owing to technological advancements enabling activity planning and tracking, increasing equipment and leisure accessibility, and more recently the COVID-19 pandemic leading more people outdoors.

Outdoor Leisure Facilities are less concentrated than Outdoor Equipment Outlets, though hotspots are more sporadic with some new hotspots emerging including the Gower Peninsula and Lands’ End. Outside of London, the area of Northern England surrounding the Peak District is best-served by outdoor leisure facilities, likely owing to the region’s high population and abundance of natural areas. These regions are famed for their abundance of hiking and cycling trails in addition to niche sports including paragliding and fellrunning, scattered more widely across the UK.

The greatest gaps in outdoor leisure facilities occur across the East Midlands and throughout Northern Scotland, presumably due to their low populations or lower tourist influxes. However, these areas are relatively better served by outdoor equipment outlets, so smaller-scale outdoor leisure facility expansion may be feasible. Excluding remote Northern Scotland and the Lincolnshire Wolds, most of the UK’s ‘precious areas’ are at least weak outdoor leisure hotspots. These facilities are strongly associated with influxes of visitors during weekends and National Holidays.

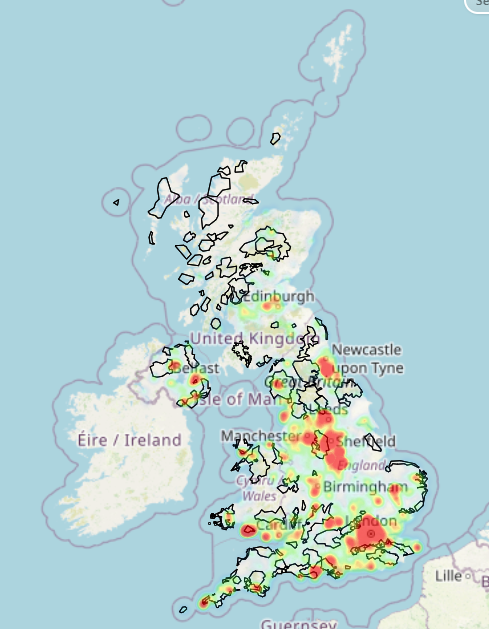

Figure 3: MVPLUS Map of UK Outdoor Leisure Facilities (Heat Map) compared to AONBs (Polygons)

Provision of Outdoor Equipment Retailers Compared to Outdoor Leisure Facilities

Figure 4 captures the relationship between outdoor equipment outlet concentration and leisure facilities. Outdoor equipment outlets are concentrated in larger settlements and adventure towns, whilst outdoor leisure facilities are more widely distributed, typically closer to or within precious areas even where equipment outlets are not present. Many of the outdoor leisure facilities outside of cities lie within the UK’s ‘precious areas’ whilst outdoor equipment outlets tend to focus on cities and towns neighbouring these regions and more reliant on higher permanent populations.

LeisureVision

is comprised 250,000+ points UK-wide, categorized into 4 large groups including sports and fitness, and further categorized into one of over 100 subcategories. The LeisureVision Destinations version is formatted into Uber’s H3 hexes (see our recent blog for more detail) , a flexible and hierarchical set of units created by aggregating mass point data, perfect for a higher-level approach to your next location planning project.

Conclusion

The UK is well-served by outdoor equipment outlets and leisure facilities, though their distribution varies and some regions, including central Wales and Northwest Scotland, are less effectively covered. Outdoor equipment outlets appeared more concentrated in larger settlements with high permanent populations, except for ‘adventure towns,’ whereas outdoor leisure facilities are more widely distributed with more hotspots also occurring in remoter areas.

If you are interested in finding out more about GMAP’s location intelligence services through RetailVision

, LeisureVision

, and geodemographic data, or our expert location planning consultancy services

, and location intelligence software and reporting

- get in touch at info@gmap.com.