The Growth of Chinese Brands in the UK Electric Vehicle Market

15th November 2023

The Battery Electric Vehicle Market Growth

Big Changes in the Automotive Market

The transition from ICE to BEV is possibly the biggest shake up the Automotive market has ever witnessed. With this, comes an opportunity for new entrants to challenge the traditional OEM’s, such as Chinese EV brands, gaining valuable market share as European brands struggle to transition their range of models from ICE to BEV. Gartner predicts that more than 50% of BEV’s sold globally will be from Chinese brands by 2026. This is no surprise given that China overtook Japan this year as the world’s biggest exporter of automobiles.

In recent years, MG have been re-born under SAIC and have aggressively entered the UK market with rapid growth, opening over 160 dealerships. Other Chinese owned brands, namely Volvo, Polestar and Lotus (all Geely owned) have developed EV offerings with Volvo owned Polestar being a dedicated EV-only brand. Lotus is currently transitioning away from being a low-volume specialist brand to a premium EV brand, with its first model the Eletre. Zeekr and Lynk & Co (also Geely owned) which will inevitably launch in the UK in the coming years.

On top of this newer, less familiar Chinese entrants are planning rapid expansion in the UK. BYD, for example, are planning to have 100 dealers in the UK by 2025 and have partnered with a number of dealer groups including Pendragon, Lookers and Arnold Clark. BYD started life as a battery production company and then transitioned into automobile production. Being responsible for their own battery production saves significant costs as well as having less reliance on external supply chain constraints. All in all, this can mean reduced lead times for consumer orders and more importantly a cheaper product.

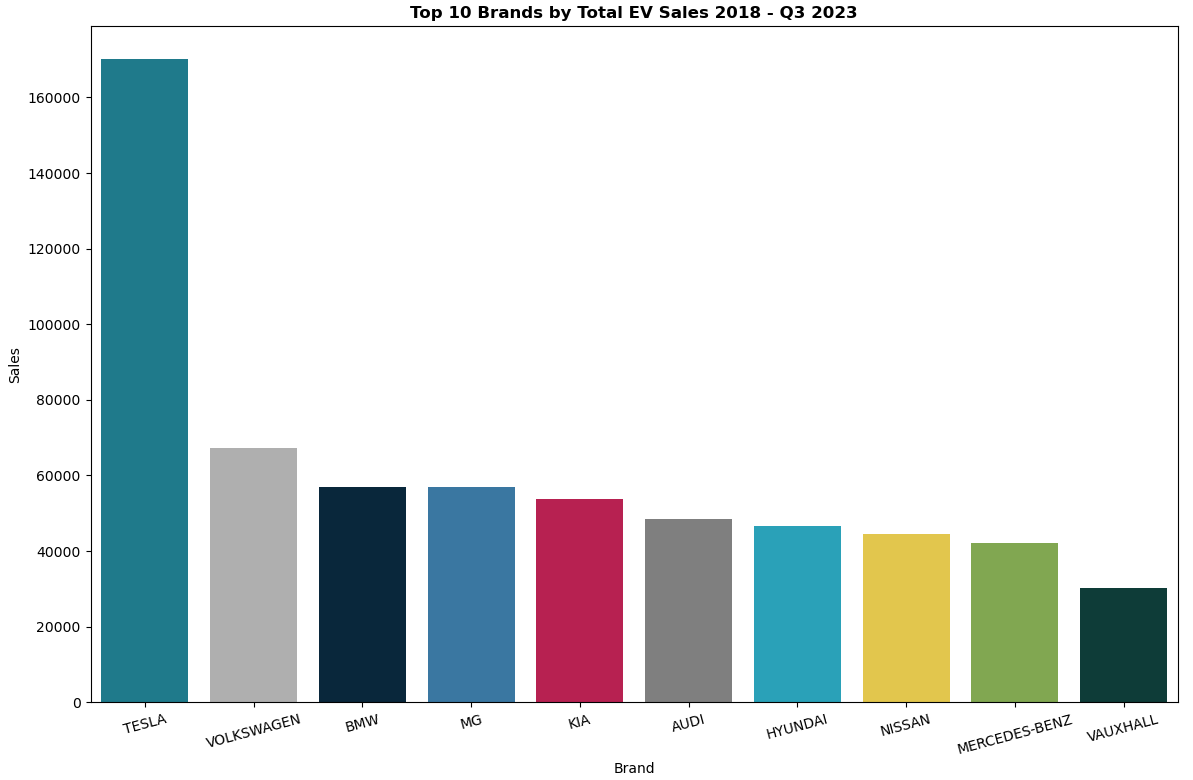

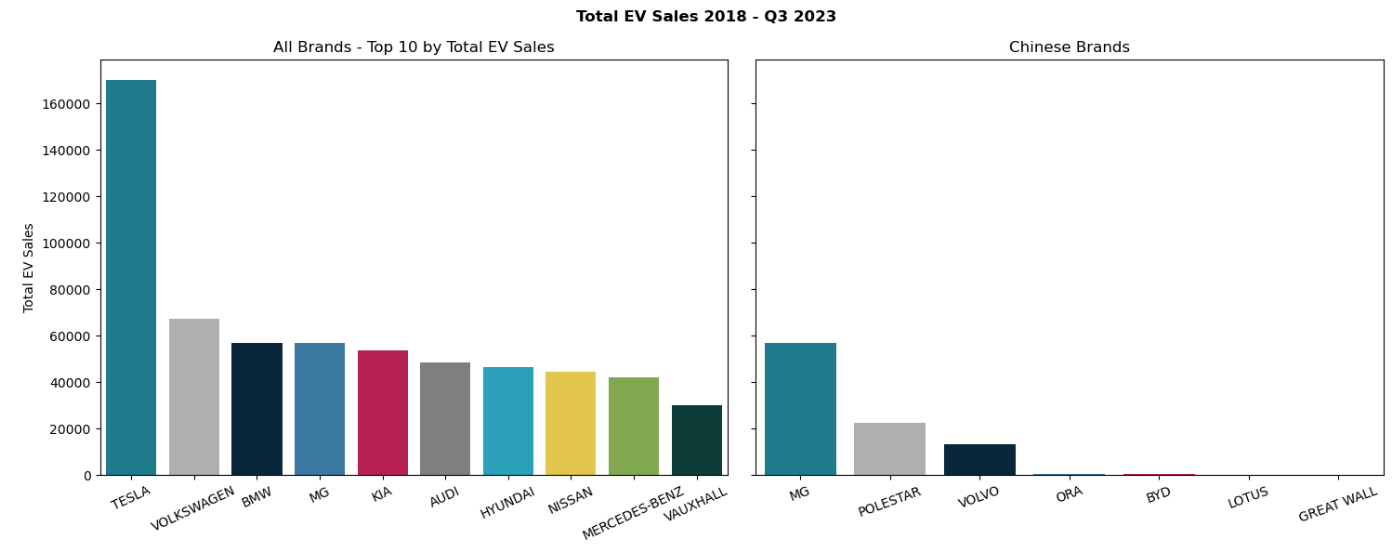

Although still relatively early days for Chinese entrants in the UK market, GMAP investigated how their share of the EV market had changed in recent years compared to the total EV car market. GMAP analysed new BEV car registrations for 2018 – Q3 2023, in Figure 2 to see how the market share of Chinese brands has changed over this period. A basket of Chinese brands containing; MG, Polestar, Volvo, BYD, Great Wall (ORA) and Lotus were used in the analysis.

New BEV car registrations surpassed the 200,000 threshold for the first time in 2022 and this figure is projected to increase again in 2023. This shows the rapid growth of the BEV market with new registrations being less than 100,000 in 2020 and less than 50,000 in 2019. Chinese brands within the EV market have also witnessed rapid growth, as shown in the figure above. The basket of Chinese brands mentioned above had a modest collective market share of around 2% in 2019, their growth has since outpaced the market to achieve almost an 18% market share up to Q3 2023. Due to the high initial cost of EV’s, the majority of these vehicles are purchased on a lease plan. If we look at just the Private market, those which have purchased their vehicle outright, we see a very similar pattern. The Private market share of the Chinese brands was around 3% in 2019, with less than 500 registrations. This has then grown to around 17% up to Q3 2023. Registrations for Chinese brands were highest in 2022 and again, this looks to be surpassed in 2023.

Electric Vehicle Sales Analysis

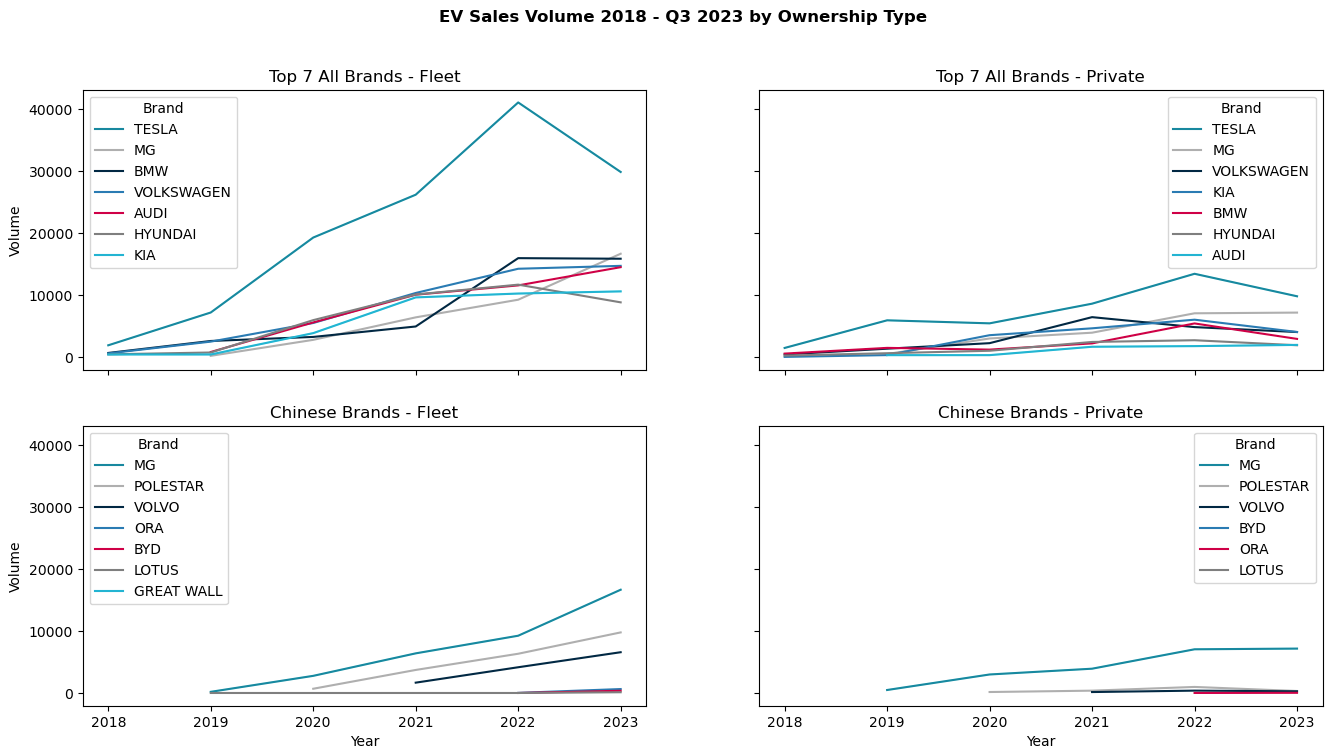

The graph above, Figures 3, shows how EV sales have changed over time broken down by type of ownership; fleet or private. Additionally, Figure 3 compares these changes over time for all brands versus Chinese brands.

In terms of individual brand growth, MG was responsible for the majority of the market share increase witnessed for Chinese brands. MG alone had more than ten times the number of new private registrations in 2023 than the other Chinese brands combined. In terms of fleet numbers, they had more than Polestar and Volvo combined. The vast majority of EV Volvo and Polestar registrations are in the form of fleets, with very few privately registered cars. It is still very early days for the other Chinese brands included in this analysis as they only had around 1,200 new registrations between them. It will be interesting to see how quickly this number grows as BYD and Great Wall owned ORA, increase the size of their dealership networks. ORA were targeting 5,000 registrations of their Funky Cat model in 2023, the data suggests they are quite a way off reaching this target.

More Chinese brands are planning to enter the UK market in 2024 and 2025, namely NIO, Xpeng and Chery. Chery are China’s largest c ar exporter so it will be interesting to see what sales model they adopt as they enter the UK. NIO are targeting 25 locations by 2025 in a direct-to-consumer sales model and look to take the UK by storm with battery swap technology in their vehicles. Xpeng is already established across Europe and is poised to enter the UK market in 2024 and will likely implement a traditional dealership model. Volkswagen recently invested over £500m in Xpeng and purchased a 5% stake of the company with the aim of using the Xpeng EV platform within their own models. This shows the confidence that the traditional OEM’s have in Chinese EV platforms.