The Retail & Leisure Proposition of the New UK Cities Announced for the Queen’s Platinum Jubilee

27th May 2022

Last week it was announced that in honour for the Queen’s Platinum Jubilee, eight new towns have been given city status. In the competition to gain city status, these cities had to prove they have a cultural heritage, royal links, and how their local identity and communities meant their deserved city status.

- Bangor, County Down, Northern Ireland

- Colchester, Essex, England

- Doncaster, South Yorkshire, England

- Douglas, Isle of Man

- Dunfermline, Fife, Scotland

- Milton Keynes, Buckinghamshire, England

- Stanley, Falkland Islands

- Wrexham, northeast Wales

Using our RetailVision

and LeisureVision products, we have looked at the retail and leisure markets in some of these new cities looks like! Overall, from our analysis we deciphered that Milton Keynes currently has the best retail and leisure proposition currently than to the rest of the new cities, whilst Bangor has the worst.

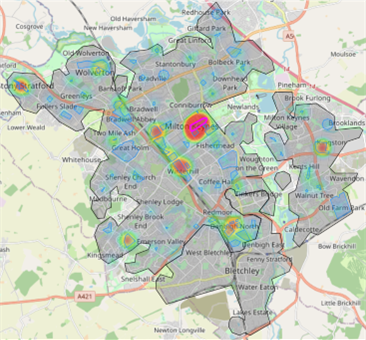

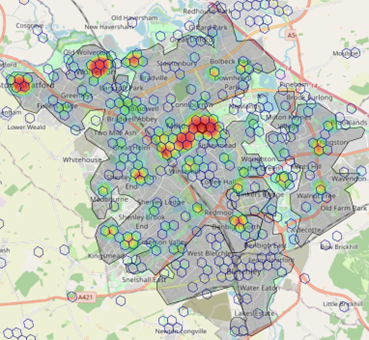

The latest Q1 2022 update of our RetailVision product tells us that Milton Keynes has the highest Revenue across Grocery, Fashion & Comparison, Electrical & Homeware & DIY. From LeisureVision, Milton Keynes has the highest count of Food & Beverage (F&B) outlet locations of the new cities. Figure 1 shows a heat map of the RetailVision Points retail location outlets within the Milton Keynes Super Trade Zone, the Retail Centres that sit within it, and the Retail Centre with the highest Retail Strength highlighted. Figure 2 shows a heat map of the LeisureVision F & B provision within Milton Keynes.

Figure 1: Retail Provision in the Milton Keynes highlighting the strength of Retail Centre: MK

Figure 2: F&B Provision in the Milton Keynes

Bangor in Northern Ireland, on the contrary, ranks lowest when it comes to RetailVision Revenue and the presence of F&B outlet locations. From RetailVision, we can see that Colchester and Doncaster sit closely to one another in terms of overall retail store location count and retail Revenue. Whilst LeisureVision indicates that Colchester has a stronger F&B outlet presence than that of Doncaster in terms of absolute counts. Furthermore, Doncaster’s retail store mix is more value orientated compared to that of Colchester.

Similarly, to Doncaster, the current store offering in Wrexham in northeast Wales is geared much towards value orientated brands, with the greatest proportion of the retail brands being categorised as Value+. The total retail store provision in Wrexham is almost half that of Doncaster. Dunfermline, on the other hand, has an overall retail and F&B presence that is slightly higher than that of Wrexham, yet, Homeware & DIY and Electrical spend is quite a bit lower in Dunfermline.

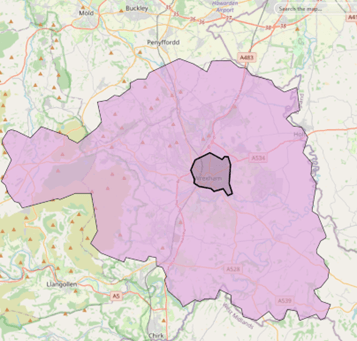

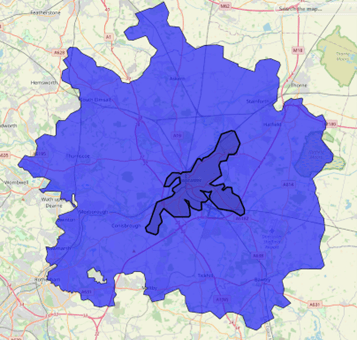

Using the RetailVision Geo-Mobility Catchments for Wrexham (Figure 3) and Doncaster (Figure 4), we can see the average di stance visitors to these destinations travel and the populations within the Catchments. Using geo-mobility data we can see how far people travel on average to a Retail Destination. With Wrexham being more rural than Doncaster it has a larger catchment (23km vs 15km) but the households it serves is 75% lower.

Figure 3: RetailVision Geo-Mobility Catchment of Wrexham, ~55,000 Households, 23km

Figure 4: RetailVision Geo-Mobility Catchment of Doncaster, ~200,000 Households, 15km

With naming the new cities, the intention is that it will drive attention and investments to these cities. It will be interesting to see, with the new city status, if the retail and leisure provisions within the city change. Only time will tell, in the meantime we will focus on celebrating the Queen’s Platinum Jubilee!

Get In Touch

Visit our RetailVision

and LeisureVision

web pages to find out more about how we did this analysis. Get in touch at info@gmap.com to find out more.