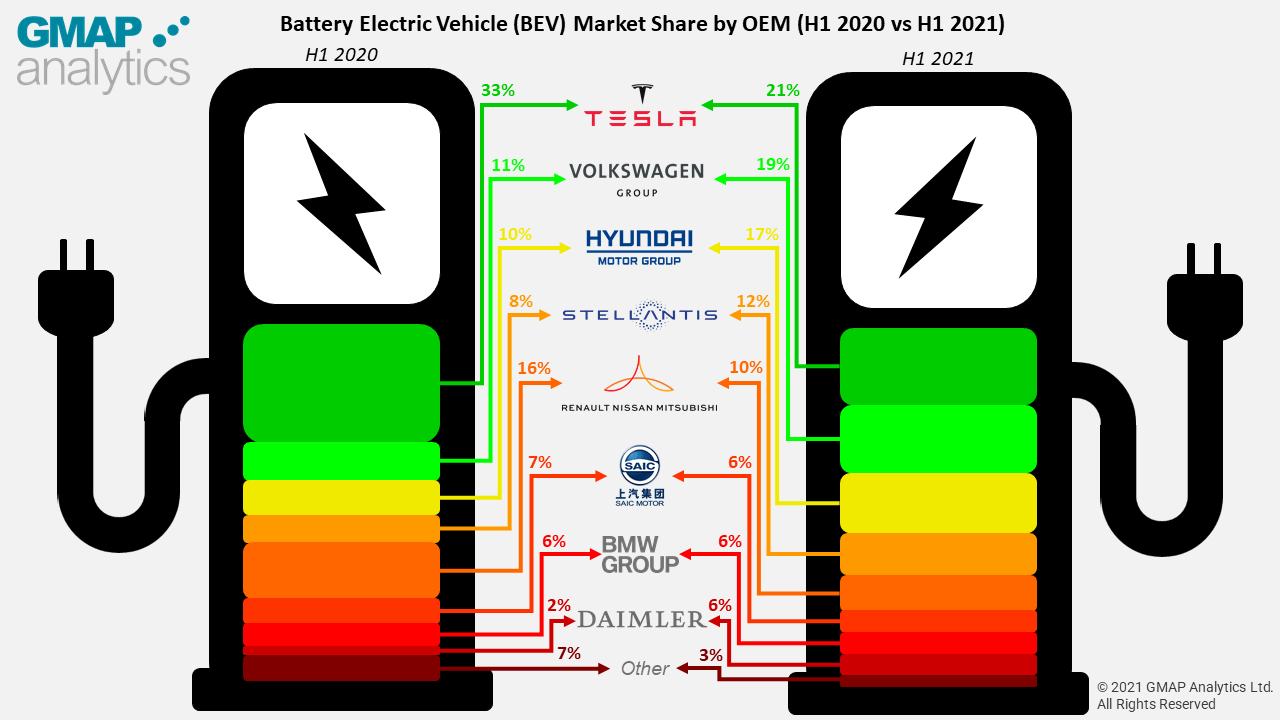

Exploring the Change in Market Share of the Battery Electrical Vehicle Manufacturers

15th September 2021

It has been well reported that sales of Battery Electric Vehicle (BEV) have been growing in the last 2 years, with the total number of newly registered BEV’s in the UK more than doubling in H1 2021 compared to H1 2020, with a clear year-on-year increase in BEV vs more traditional internal combustion engine (ICE) vehicles. But how does this look at an OEM level? GMAP have used our DVLA dataset to explore the BEV market share of OEM’s from H1 2020 compared to H1 2021:

The immediate finding was that for both time periods studied, Tesla has the highest UK BEV market share compared to all other OEM’s with 33% of the market in H1 2020 and 21% in H1 2021 respectively. However, the figures show a significant decrease in UK market share between time periods. Despite this decrease in UK market share, Tesla registered around 145% more vehicles in H1 2021 than the same period in 2020.

‘The total number of newly registered BEV’s in the UK more than doubled in H1 2021 compared to H1 2020’

Tesla have tended to have the premium end of the BEV market to themselves. However, this has more recently been challenged by VWG (Audi e-tron SUV, Porsche Taycan and most recently, the Audi e-tron GT) and Mercedes. The impact of production delays is also a factor here, something that is affecting all producers. Orders for the new Tesla Model S, for example, are delayed until the end of 2022.

At the lower end of the UK BEV market, a number of more affordable BEV models have been released in recent months, increasing market share of other OEM’s in the UK market.

The release of models such as Volkswagens ID.3 and ID.4, which first appear in our data in Q3 2020 and Q1 2021 respectively, in conjunction with their existing BEV offering (e-up and e-golf) have caused significant increases in new registrations between the two time periods studied. In H1 2021, there was over 3 times the number of newly registered BEV’s than H1 2020.

Similarly, the Hyundai Motor Group enjoyed an increase in registrations in this time period. Hyundai and Kia have been key brands in the UK BEV market for some time and Kia’s release of multiple new e-Niro models (e-Niro ‘2’, e-Niro ‘3’ and e-Niro ‘4+’) in Q3 2020 have driven this increase. Sister brand Hyundai announced in 2020 that the Ioniq would become its sub-brand for pure BEV offerings, releasing the award winning Ioniq 5 in Q2 2021.

Stellantis, the Fiat Chrysler and Peugeot Joint Venture, has grown more than threefold; mainly from the Peugeot and Vauxhall brands. This maybe attributed to the release of new commercial BEV’s, such as the Vauxhall Vivaro-e, especially between Q2 2020 and Q1 2021, and the Peugeot E-Expert models between Q3 2020 and Q1 2021.

Interestingly, the Renault-Nissan-Mitsubishi Alliance, one of the earliest OEM’s to enter the BEV market, witnessed a significant decrease in market share despite selling an increased number of vehicles (a similar picture to Tesla). Again, this is due to more competitors entering the market and perhaps a lack of new product from this group in period. As far as cars are concerned, Renault still only offer the Renault Zoe, Nissan the Leaf.

Over the next few years, as more and more brands enter the BEV market and existing brands expand their ranges, it’s going to be interesting to see how the market changes and which OEM’s emerge as key players in the battle for the UK market. Will Tesla maintain its position at number one or will the more traditional OEMs over-take as the product focus shifts downmarket?

If you would like to know more about the DVLA dataset

or find out about GMAP's expertise in the automotive sector, please get in touch at info@gmap.com.