Impacts of the Asos & Boohoo Acquisitions of the Arcadia Group Brands

10th February 2021

Earlier this week on Monday 8th February, it was announced that online fashion retailer Boohoo is purchasing the Burton, Dorothy Perkins and Wallis brands and their online business operations in a £25.2m deal. This comes one week after Asos, another online fashion retailer, announced it would be purchasing the Topshop, Topman, Miss Selfridge and HIIT brands in a £265m deal for the brands, with an extra £30m for their stock.

Just over two months since entering administration, all the Arcadia Group’s brands have now been sold off to online retailers or closed. The Arcadia brands that were once the face of the UK high street, no longer have a physical monopoly. What does this mean for the UK retail landscape? At GMAP we have been looking at our RetailVision product to assess the impact the loss of the physical Arcadia brands will have on the UK retail landscape.

At GMAP using RetailVision Points, our comprehensive store locations database, we have assessed the impact of the store closures of the brands brought by Asos and Boohoo, including Topshop, Topman, Miss Selfridge, Burton, Dorothy Perkins and Wallis, will have on retail Destinations. To truly derive the impact of the Arcadia Group’s devolution, we have analysed the locations that existed in November 2020, prior to when Arcadia went into administration.

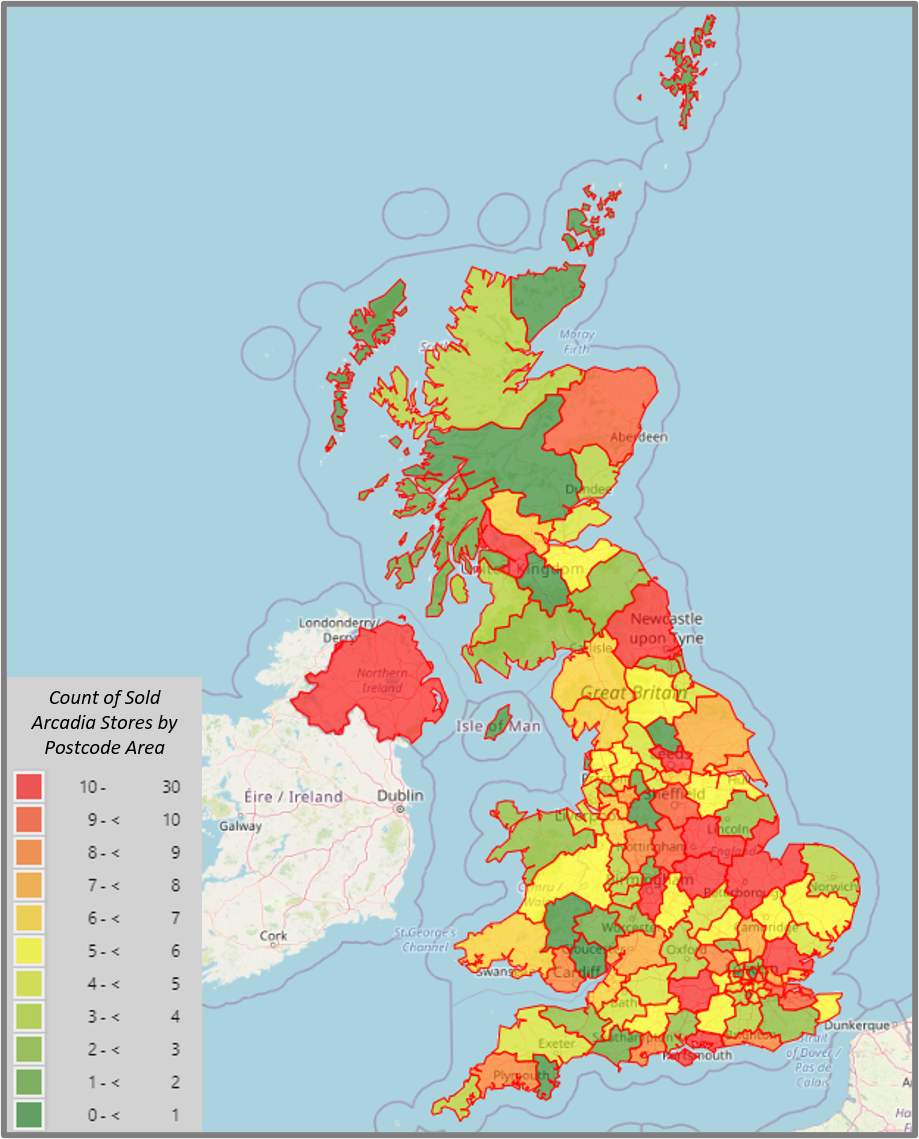

We used our MVPLUS mapping tool

to create the following map, which depicts the Postcode Areas with the highest count of store closures that will be occurring from the Asos and Boohoo purchases. This map highlights that the areas in and around Northern Ireland, Newcastle upon Tyne, Leeds, Essex, Reading, and those in the corridor across the Midlands to the East coast will have the highest number of store closures by Postcode Area.

To further assess the impact these closures will have on retail landscape we conducted analysis using RetailVision Destinations. RetailVision Destinations is a detailed illustration of the UK’s retail landscape with approximately 21,000 Retail Centres, combined into 13,000 Trade Zones and further grouped into 800 Super Trade Zones. The closure of the stores for these brands will affect:

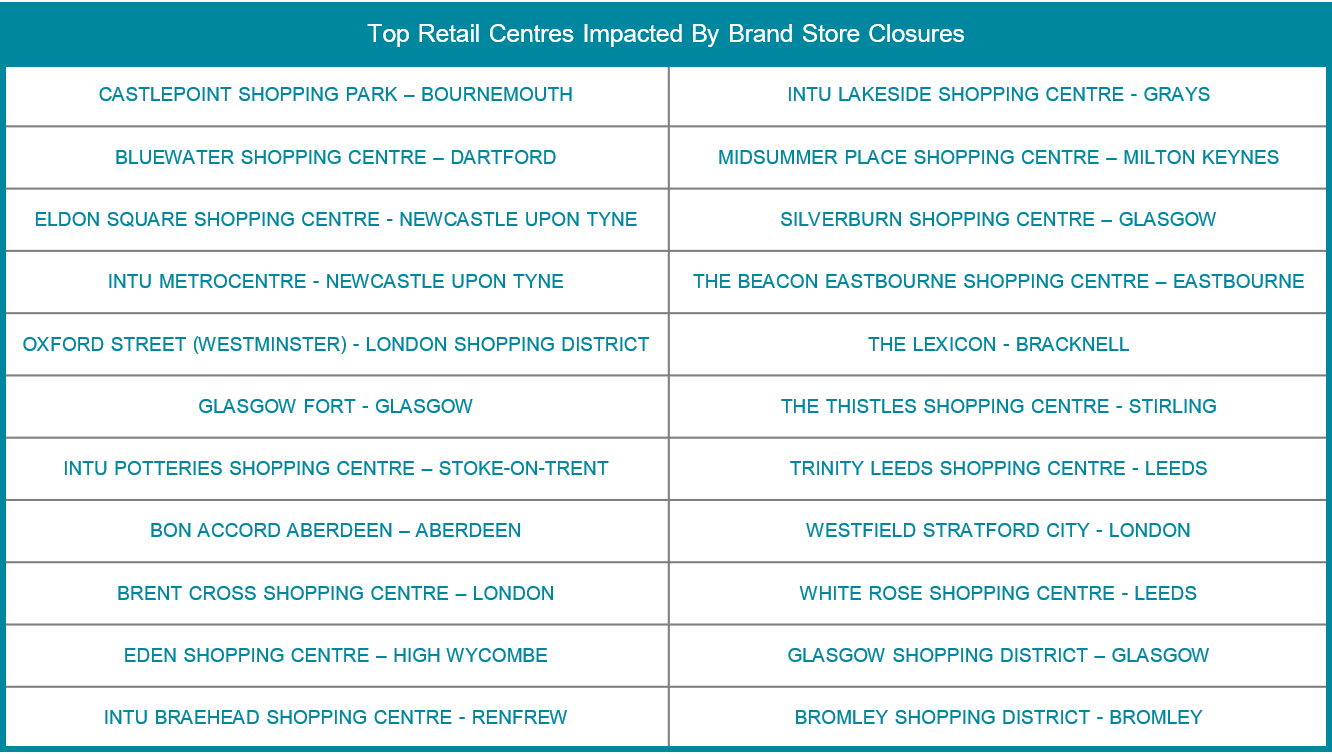

The following table in Figure 3 shows the Retail Centres that will be most affected with the highest number of closures:

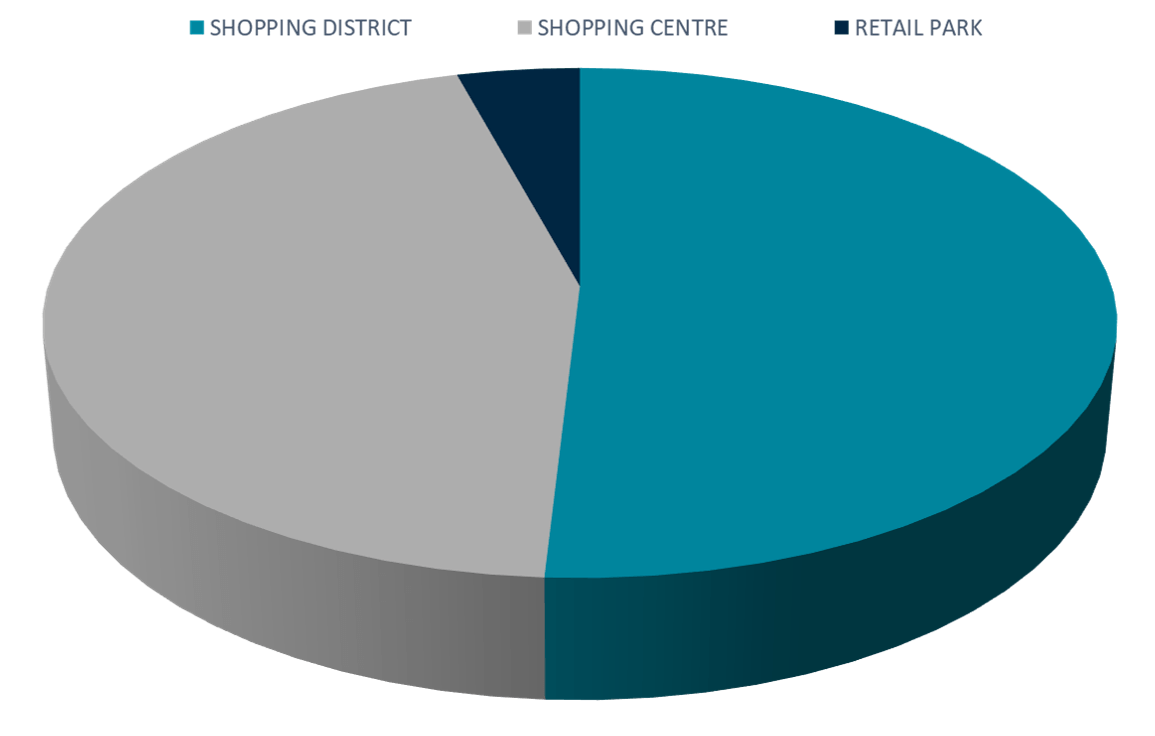

Analysis of the Retail Centre types, in Figure 4 below, derived that of all the centres that will be affected by the store closures, 51% were in Shopping Districts, 45% in Shopping Centres, and 4% in Retail Parks:

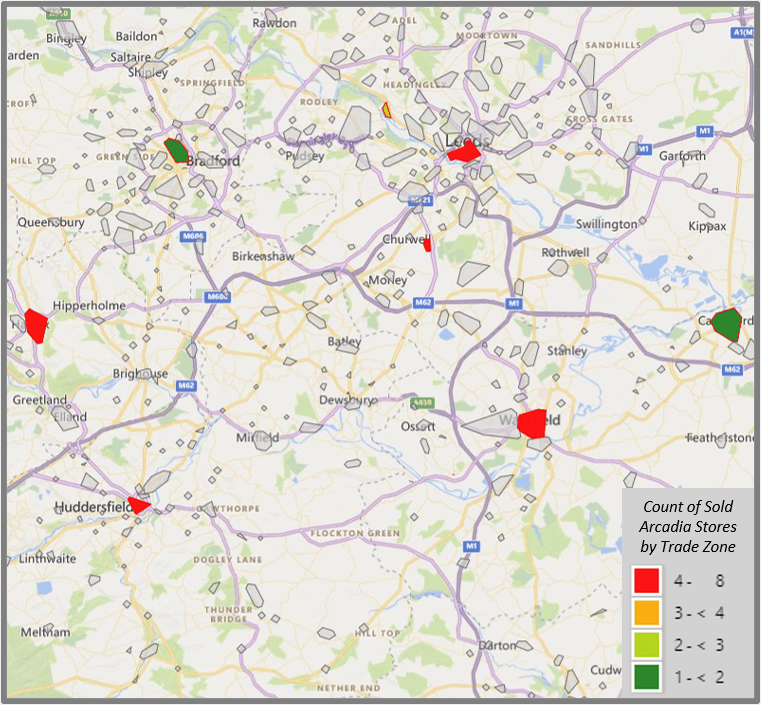

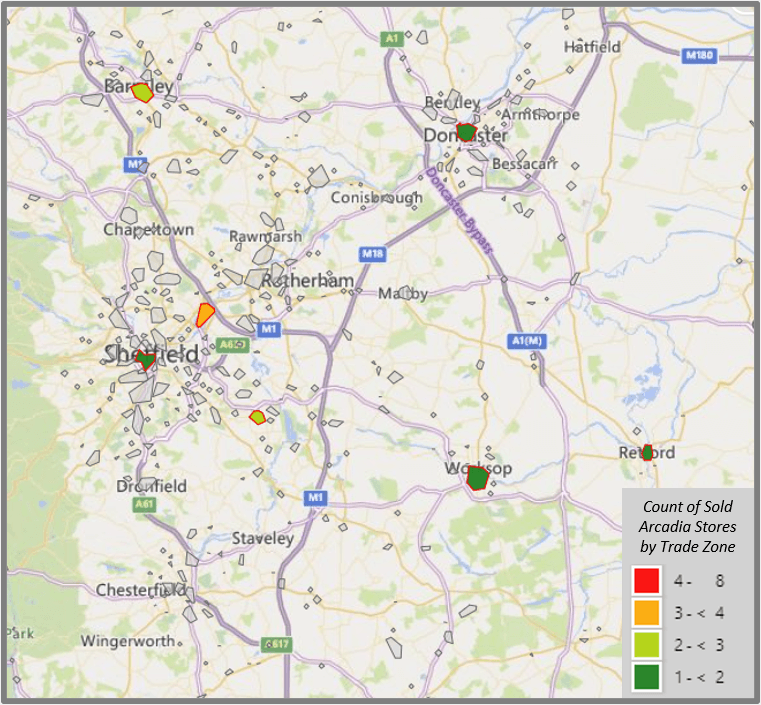

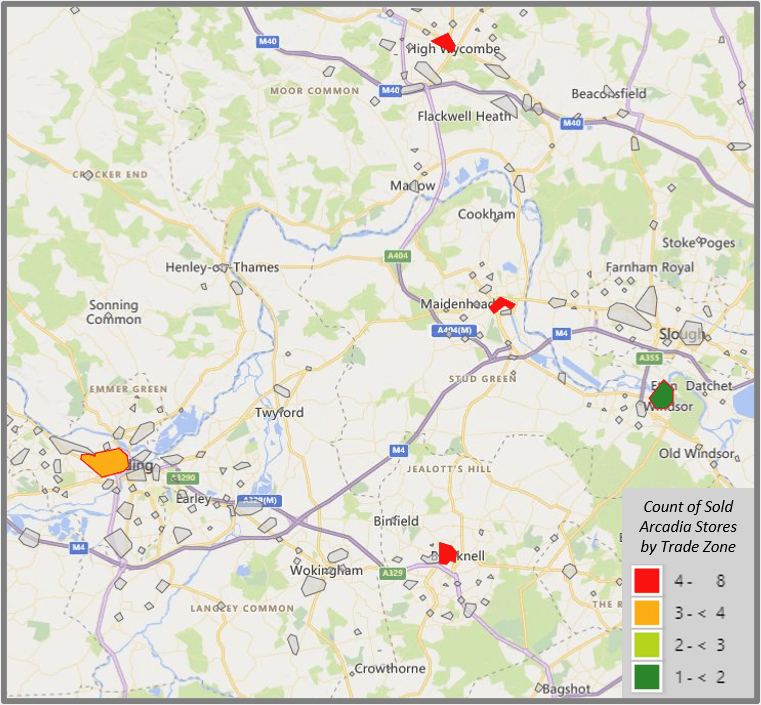

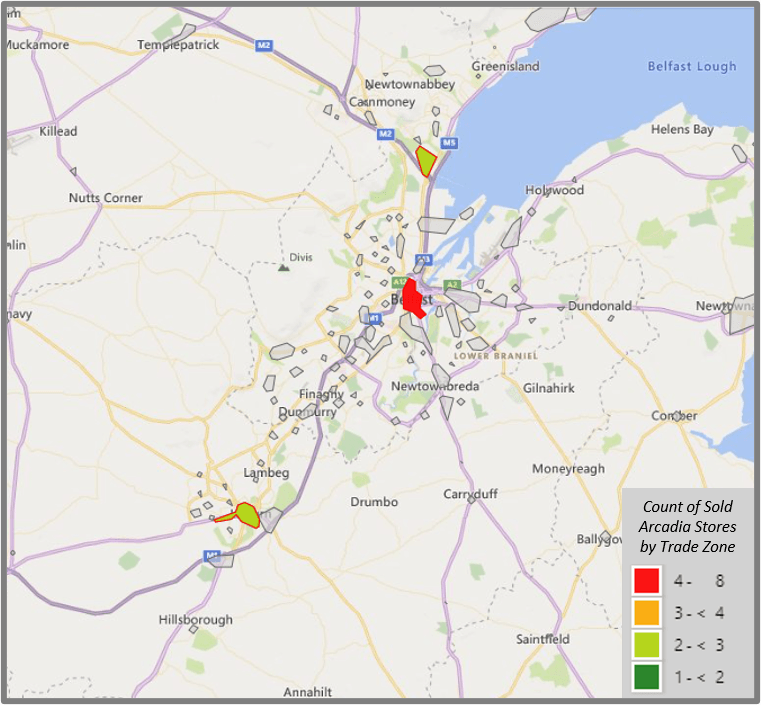

To see the regional depiction of the impact of these closures, some of the Postcode Areas in Figure 1 with the highest closure counts were further analysed at Trade Zone level, aggregated Retail Centres, using MVPLUS.

The following maps in Figure 5 depicts the Trade Zones with some of the highest count of store closures that will be occurring from the Asos and Boohoo purchases. These maps show that some of the Trade Zones with the highest numbers of closures will be in city centres, including Leeds and Belfast. However, the centres in regional cities and towns will also be greatly impacted by the closures, such as Wakefield, Huddersfield, Maidenhead, High Wycombe, Bracknell, and Barnsley.

In the current lockdown, shoppers are unlikely to feel the impact these vacancies will have on Retail Destinations. When we return to our High Street and Retail Centres, they will not be what we used to know and there will be rifts where the Arcadia brand stores used to be. Consumers will be able to access these brands online, run by Asos and Boohoo. However, will it be the same? What and who is likely to enter the spaces these brands used to dominate?

Find out more about GMAP’s services including our RetailVision Points

store locations database, RetailVision Destinations

and MVPLUS software

or get in touch to let us know what you think the future of UK retail will look like!