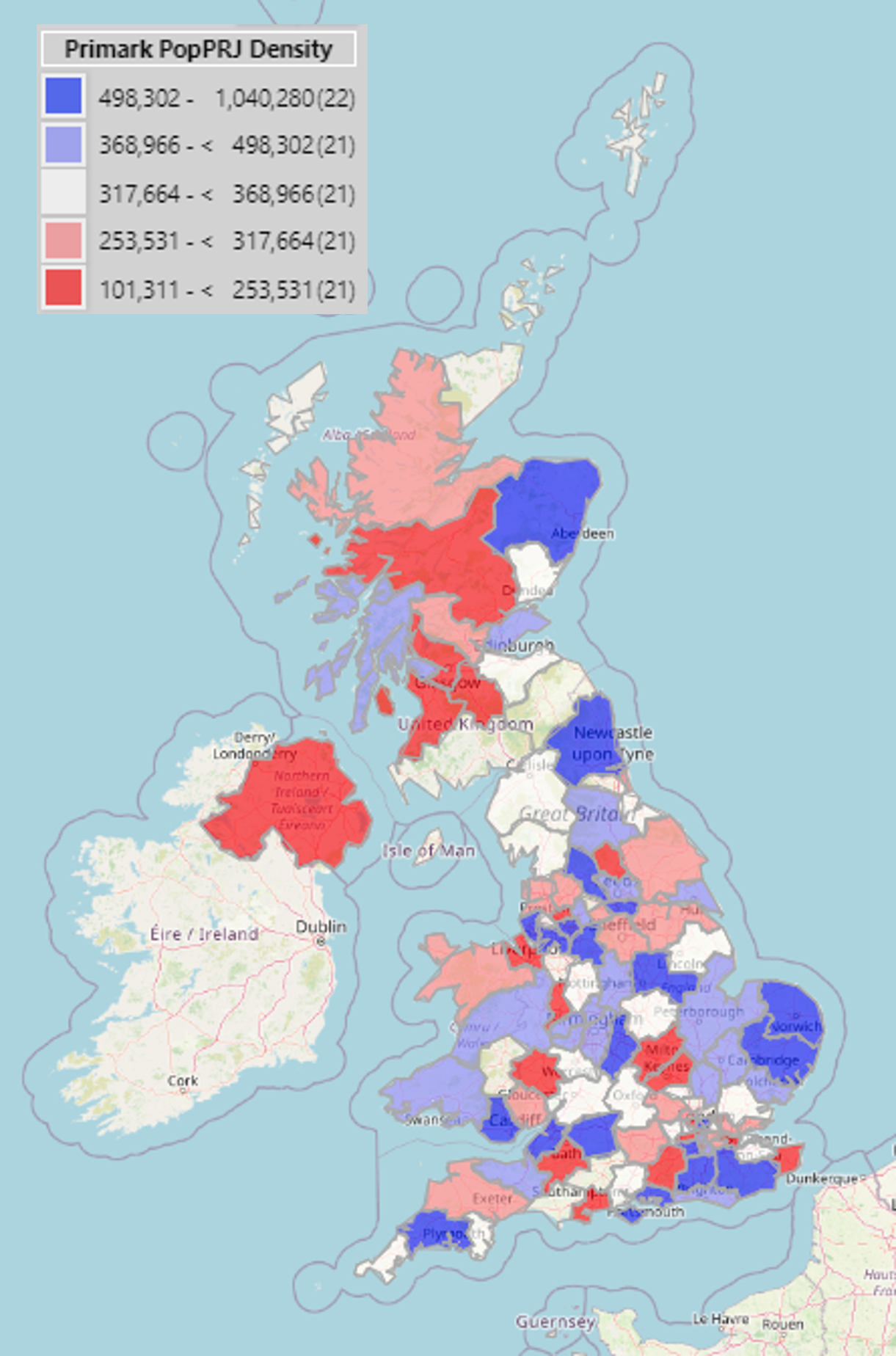

The maps reveal differing patterns of the density of projected population per location. There is a high density of people per Primark store in Northern Ireland, Glasgow and throughout postcode areas in the Midlands and the South. Interestingly, the areas with a low density of people per Primark tend to be neighbouring the areas with a high density, showing Primark’s potential awareness of store cannibalisation.

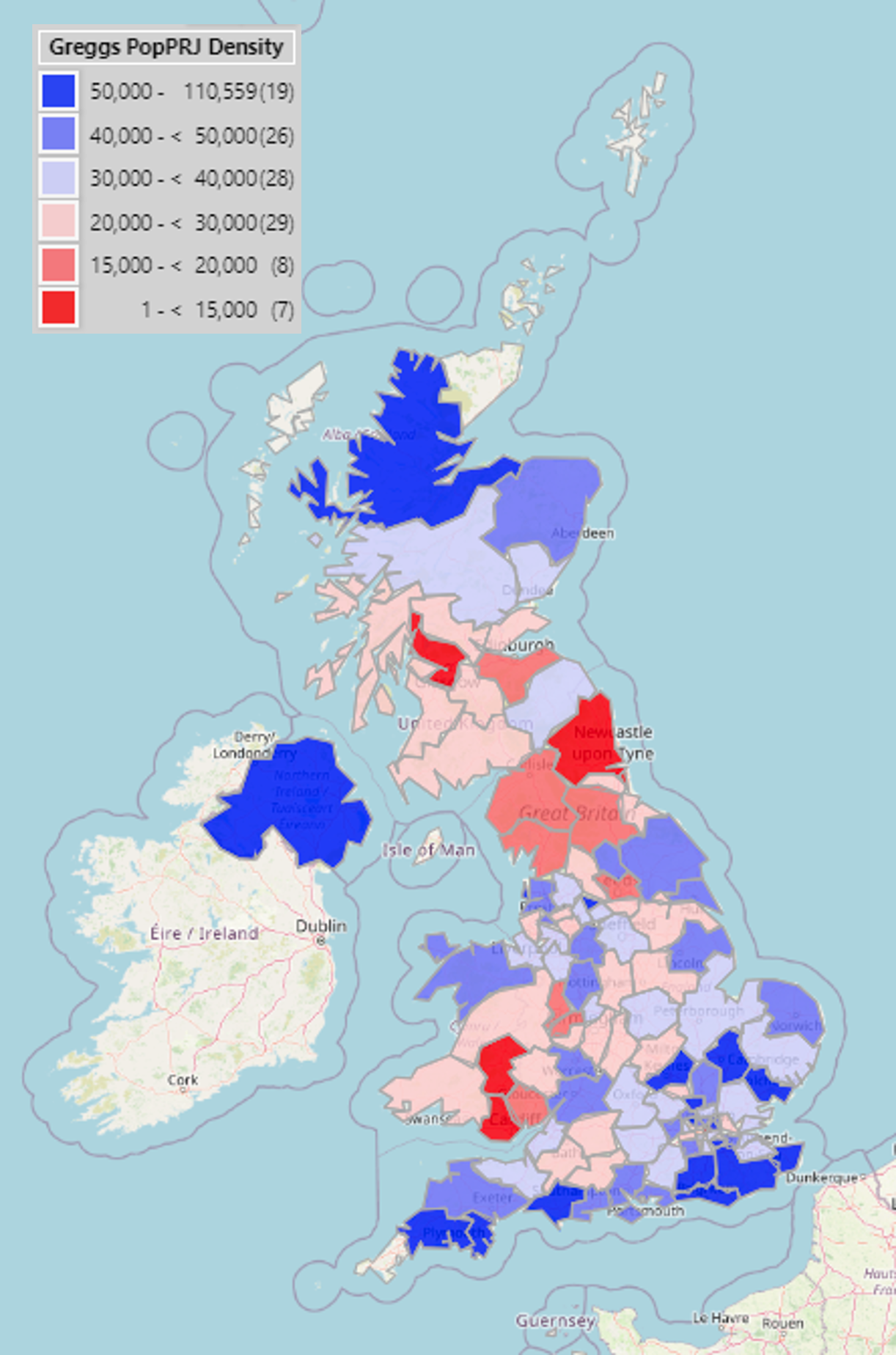

The postcode areas with a high density of people per Greggs are Newcastle, where Greggs originated, South Wales and Glasgow. It is evident that there are far fewer Greggs in the far South and North of Britain, and in Northern Ireland. Further collaboration with Primark could lead to a greater presence in these regions, as Primark has a high density of people per shop in Northern Ireland, Scotland and the far South of the UK.

Location Planning Opportunities: Areas for Future Collaboration

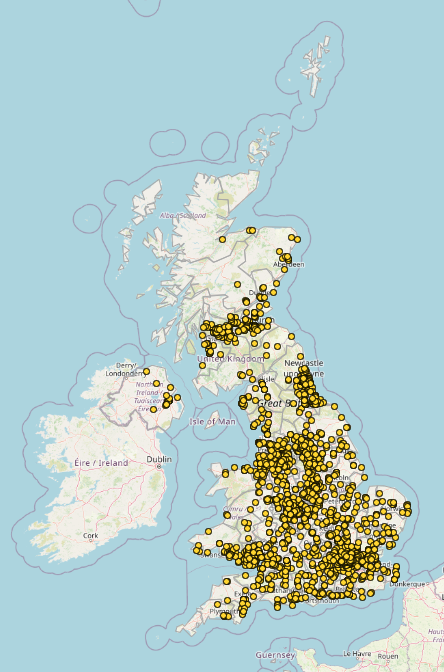

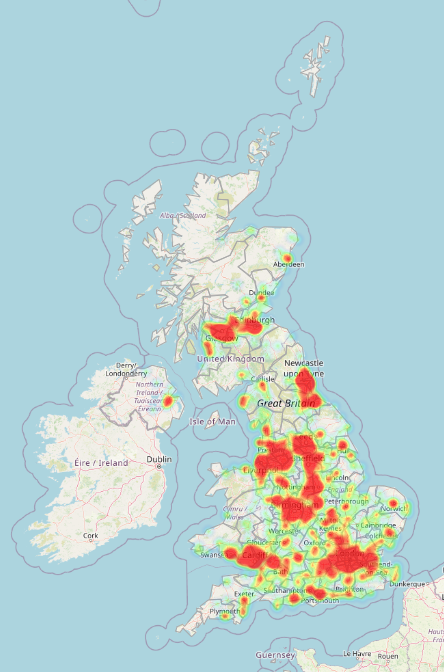

We analysed the locations of both Greggs and Primark Shops and found three areas where there are no Greggs within 20 kilometres of a Primark shop, a clear opportunity for further collaboration and retail location planning.

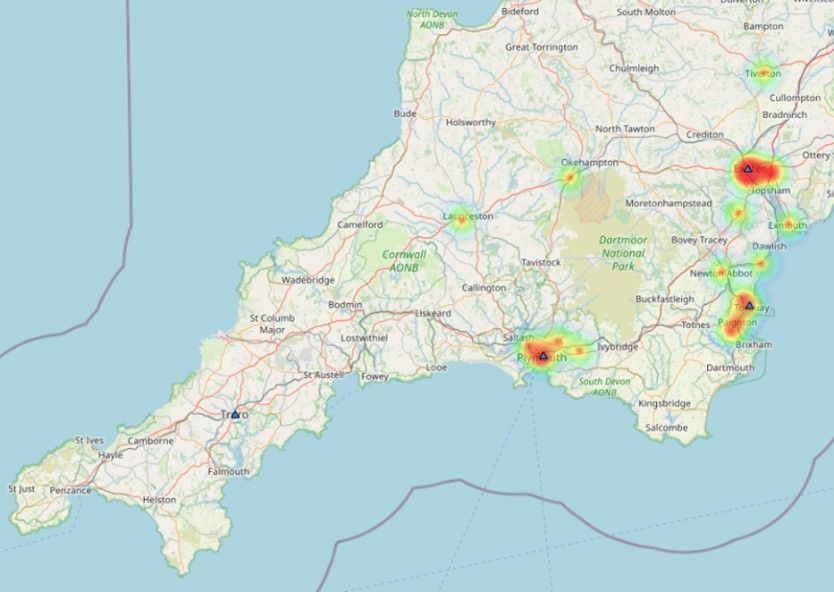

Figure 9: Heatmap of the Greggs shops in Cornwall and the Primark Shops, from MVPLUS

The Primark in Truro is 89 kilometres drive from the nearest Greggs, and the area is evidently empty of any Greggs or other Primark shops for over 80 kilometres. This is an obvious spot for more investment and future collaborations, particularly soaking up on the summer tourist trade and travel.

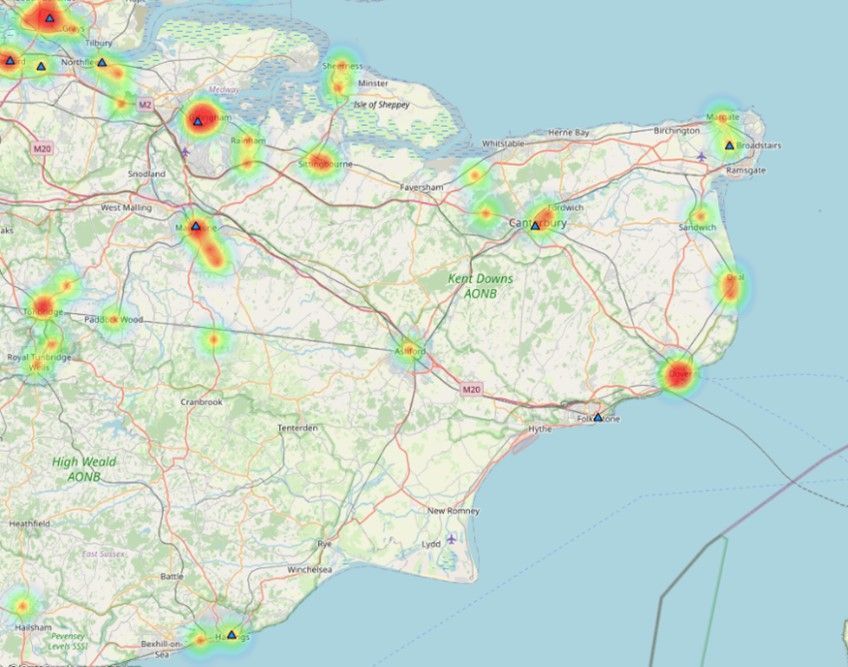

Figure 10: Heatmap of the Greggs shops in Kent and the Primark Shops, from MVPLUS

The Primark in Folkestone is over 13 kilometres from the nearest Greggs, in Dover, and over 70 kilometres from the Greggs further down the coastline in Hastings. Although possibly a prime location for another Greggs, the southern customer market are less exposed to Greggs and therefore too many Greggs in this region may lead to cannibalisation or low profits due to poor use.

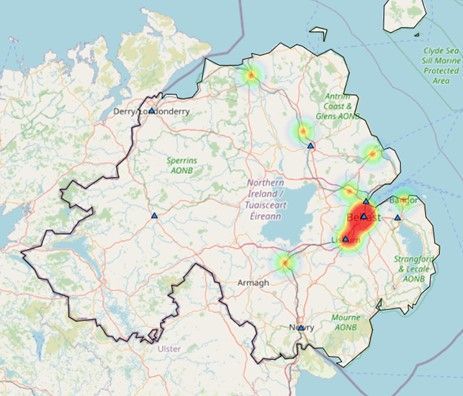

Figure 11: Heatmap of the Greggs shops in Northern Ireland and the Primark Shops, from MVPLUS

In Northern Ireland there are multiple Primark Shops without a Greggs within 20 kilometres. The vast majority of Greggs in Northern Ireland are in Belfast, whereas the Primark Shops are spread throughout the country. This is a potential new market for Greggs to expand, and collaboration with the existing Primark Shops could help them to achieve this in cost effective way.

Conclusion

Whether Greggs and Primark’s retail collaboration will go as viral as Barbenheimer is still to be seen, but the network strategy compatibility, the similar customer profile and pricing strategies and the yin-yang store locations all bode well for a successful retail collaboration. Could retail collaborations rejuvenate you as a British retailer after the impact of COVID-19? Our RetailVision data, MVPLUS

and our location planning consultancy services

are here to help.

To find out more about GMAP’s intelligence data and software products including MVPLUS, or our location planning consultancy services – get in touch at

info@gmap.com.