What are the UK’s Top 10 Retail Centres?

2nd February 2023

The Top 10 Retail Centres in the UK, by RetailVision Centre Revenue

At GMAP, we have used our RetailVision dataset to establish the Top 10 Retail Centres in the UK at the start of 2023, based on Centre Revenue Estimates!

The UK’s Top 10 Retail Centres:

- Oxford Street

- West Brompton, Knightsbridge

- Carnaby Street

- Manchester Shopping District

- The Trafford Centre

- Glasgow Shopping District

- Bluewater

- Liverpool One

- Covent Garden

- Westfield London

We have created a report, which you can download below, outlining some of the key attributes of each of the top 10 Centres. For every Centre, you can visualise and compare the following variables:

- Centre Total Rank – Retail Centre Rank Overall within the UK by Revenue

- Centre Type – Retail Centre Type (e.g. Arcade/Parade, Shopping Centre, etc.)

- Trade Zone – Retail Trade Zone name the Retail Centre is located in

- Trade Zone Rank – Trade Zone Rank overall within the UK

- Super Trade Zone – Retail Super Trade Zone name the Centre is located in

- Super Trade Zone Rank – Super Trade Zone Rank Overall within the UK

- Estimated Annual Revenue – Retail Centre Total Revenue (£) for all products

- Centre PMV+ Status – Proportion of Retail Points by PMV by Retail Centre vs. the national proportion of Retail Points by PMV

- Fashion & Comp Centre Rank – Retail Centre Rank for Fashion & Comparison within the UK by Revenue

- Centre Catchment Population – Population within the Retail Centre Catchment

- Centre Footfall Rank – Retail Centre Rank based on the Footfall Index

- Visitor Travel Distance – The range of the maximum distance (km) travelled to the Retail Centre by 60% of the people that visited the centre

- Revenue Split by Product Type – Proportion of Revenue by each Product

- # Store Split by PMV+ Status – Count of Retail Points by PMV+ Status (Value, Value+, Mass, Mass+, Premium)

- # Store Split by Category Type – Count of Retail Points by Category Type

RetailVision Estimates the Top Retail Centre in the UK is: Oxford Street

A surprise? Probably not. However, given the turmoil the retail industry has faced the past few years we are glad to see that the UK’s top retail tourist destination remains on top! In 2019, we were witnessing a “retail apocalypse” with headlines of “Death on the High Street” becoming commonplace as physical stores had been closing increasingly year on year for a decade (read our whitepaper on “Let’s Get Digital But Stay Physical: Surviving the Retail Apocalypse”).

This was only exasperated by the Covid-19 pandemic in which temporary physical store closures meant footfall and sales were hard hit, only leading to the closure of more stores and further brand collapses. Oxford Street’s notorious Topshop flagship was one such casualty, which was closed after Phillip Green’s Arcadia Group went into administration in 2021.

Nevertheless, almost three years on since Covid-19 caused our stores to close, international tourism to be grounded, and homes to become workplaces, Oxford Street has the highest Retail Centre Revenue, with estimated spend of £946million. Furthermore, it is the top Fashion & Comparison Centre in the UK, with a high volume of Mass and Mass+ stores. It has the 5th highest Footfall in the UK, and shoppers travel from a vast distance to visit this key retail destination. 3.2million people live in the Catchment of the Oxford Street Retail Centre.

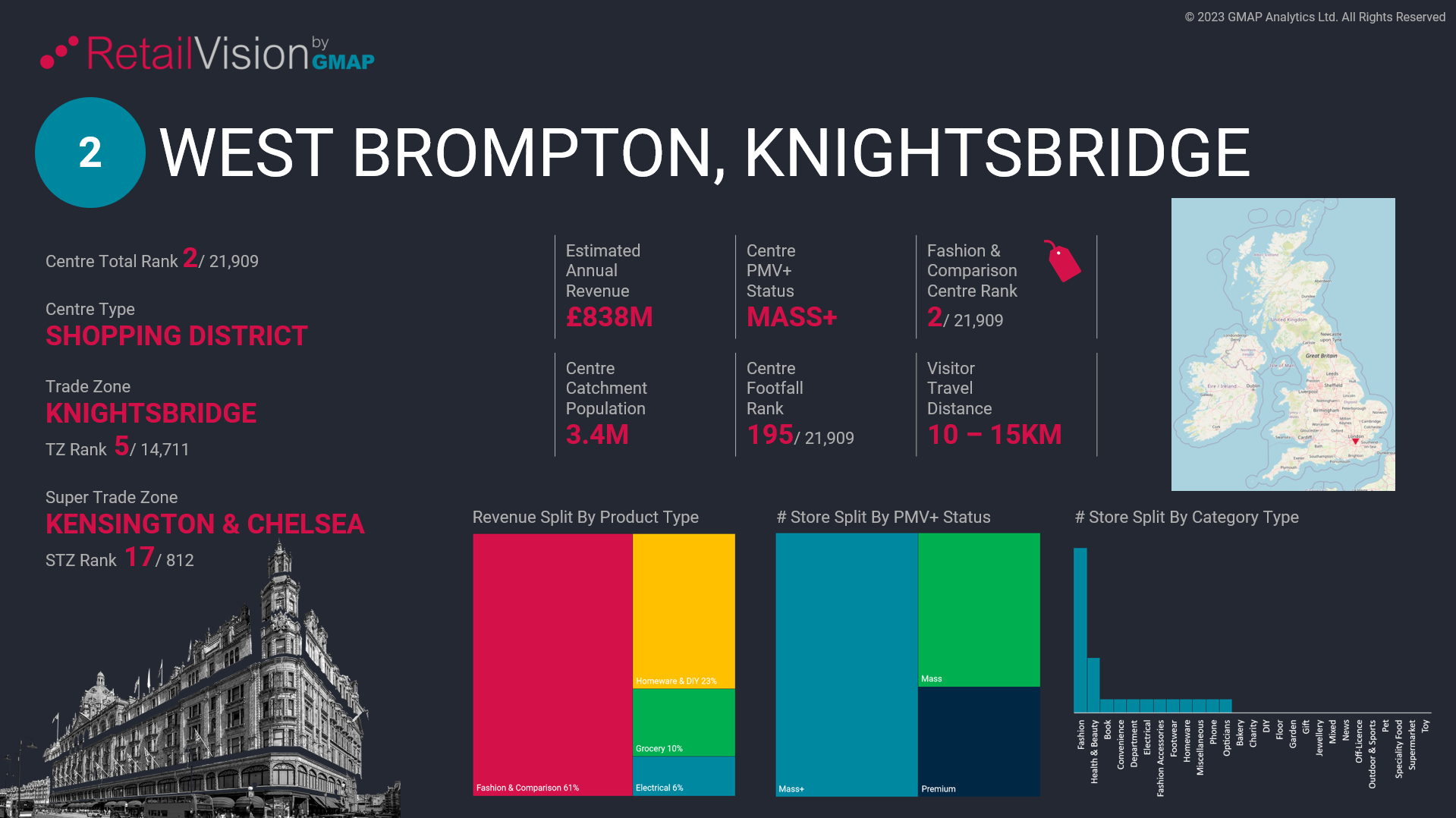

2nd Top UK Retail Centre: West Brompton, Knightsbridge

Knightsbridge has the 2nd highest Retail Centre Revenue in the UK, and also ranks 2nd for Fashion & Comparison in the UK. Home to Harrods, amongst many other Premium stores, this Centre has no Value or Value+ brands! Whilst not of all Harrod’s tourist Footfall traffic will be contributing to the Revenue, it is clear not everyone visiting this Centre is just window shopping…

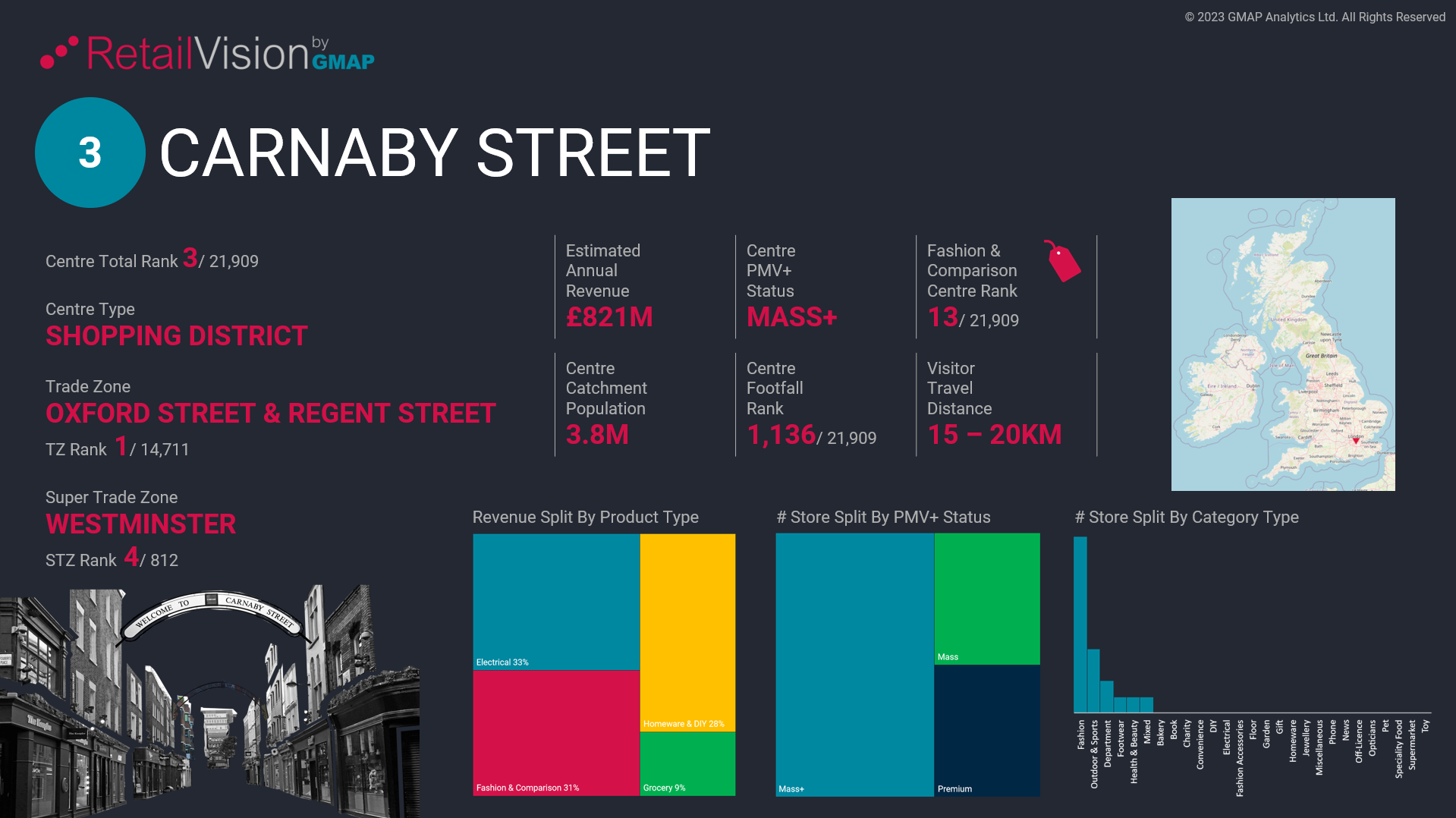

3rd Top UK Retail Centre: Carnaby Street

Clearly, Carnaby Street’s heyday isn’t over as it ranked as the 3rd Retail Centre in the UK! Neighbouring Oxford Street, the Centre attracts people from a vast distance. The mix of retail and leisure operators in and around Carnaby Street, including Kings Court, as well as Liberty’s means Carnaby Street remains a key UK shopping district.

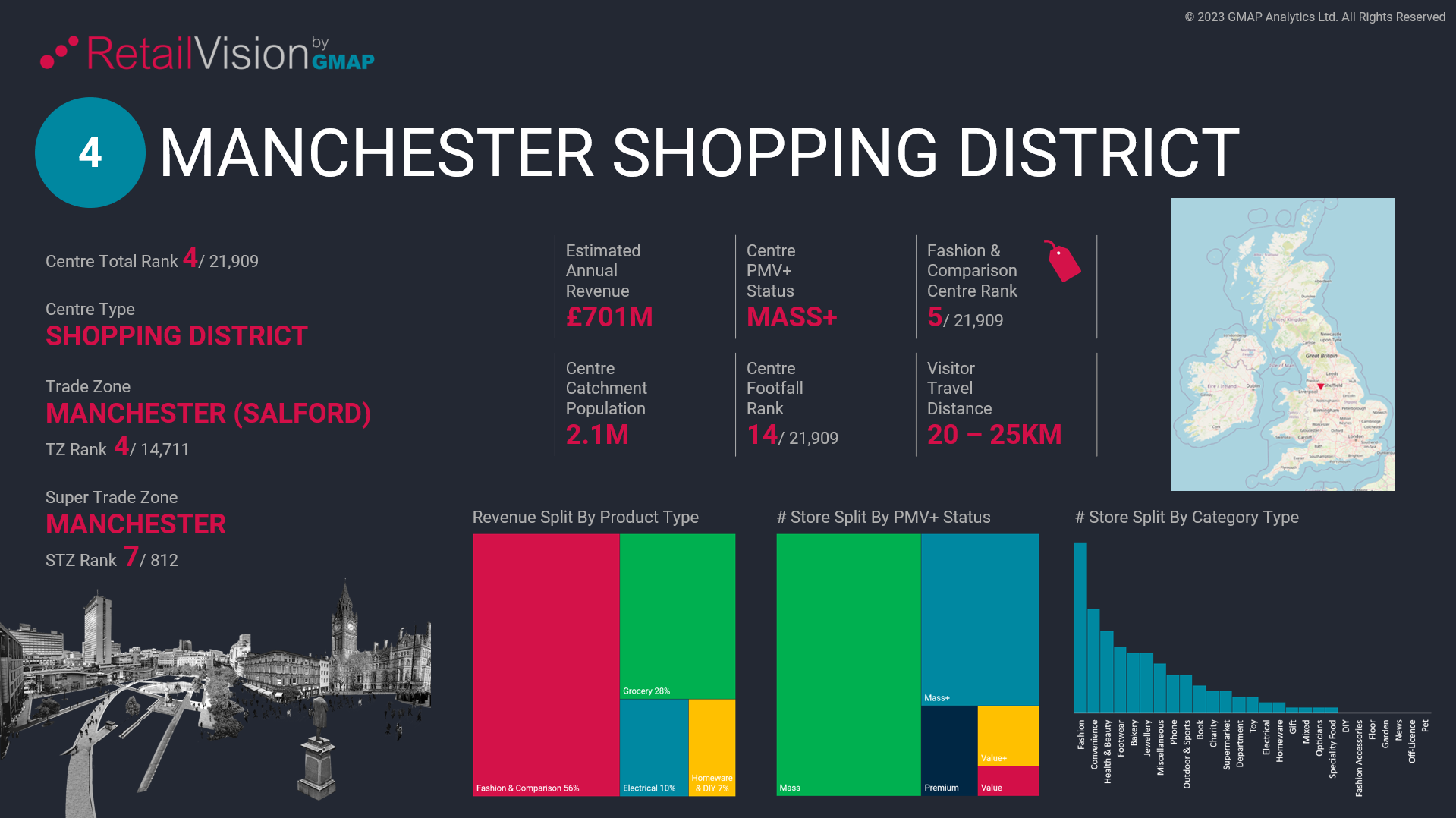

4th Top UK Retail Centre: Manchester Shopping District

Next stop, we head North to Manchester! Manchester Shopping District ranks 4th for Retail Centre Revenue, and 5th for Fashion & Comparison. Visitors travel far to this key city centre retail destination. The Centre Catchment is home to a population of 2.1million. There is a mix of store types, with a high presence of Mass stores.

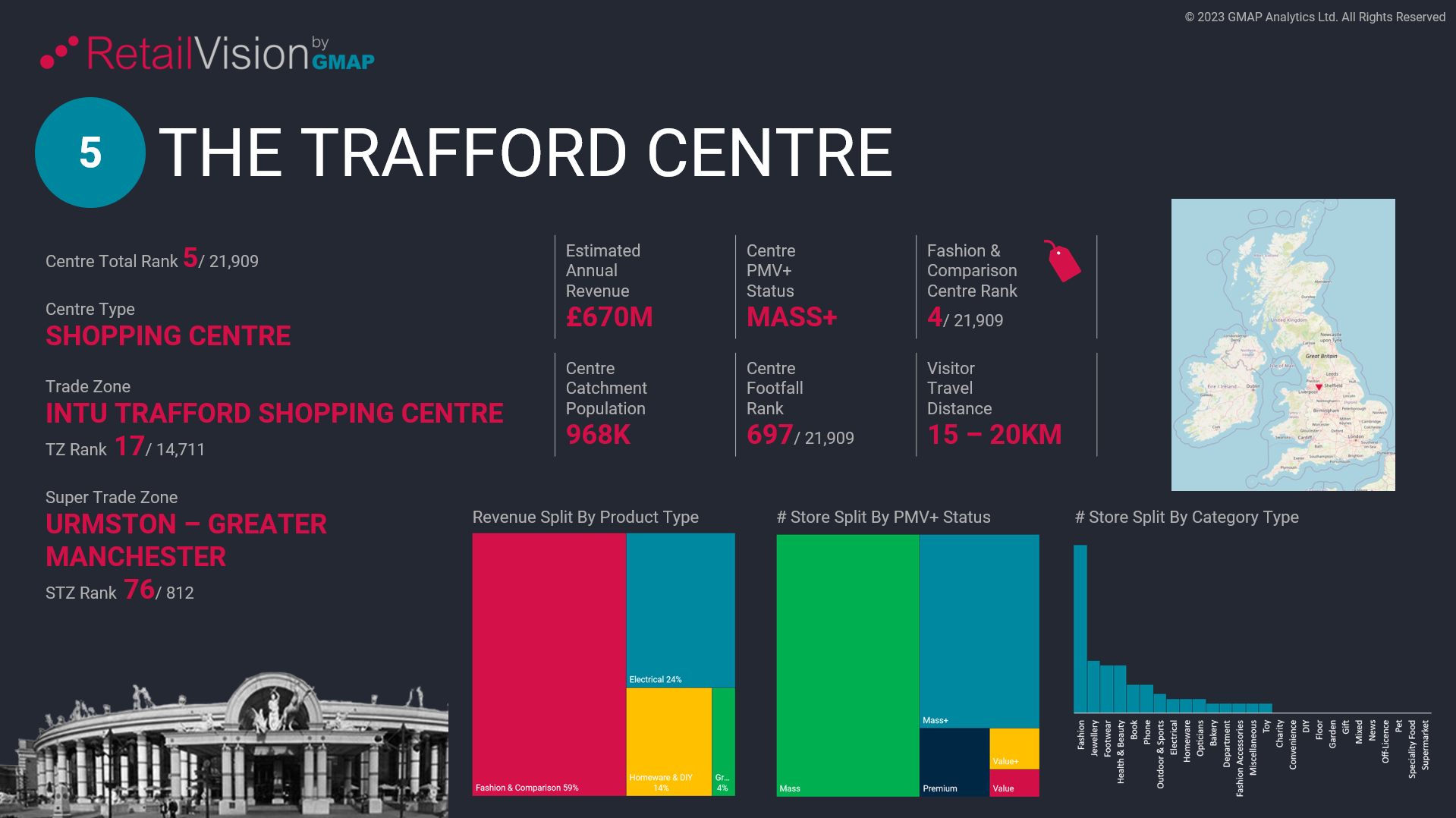

5th Top UK Retail Centre: The Trafford Centre

The Trafford Centre, on the outskirts of Manchester, is the 5th ranking Retail Centre, and 4th destination for Fashion & Comparison.

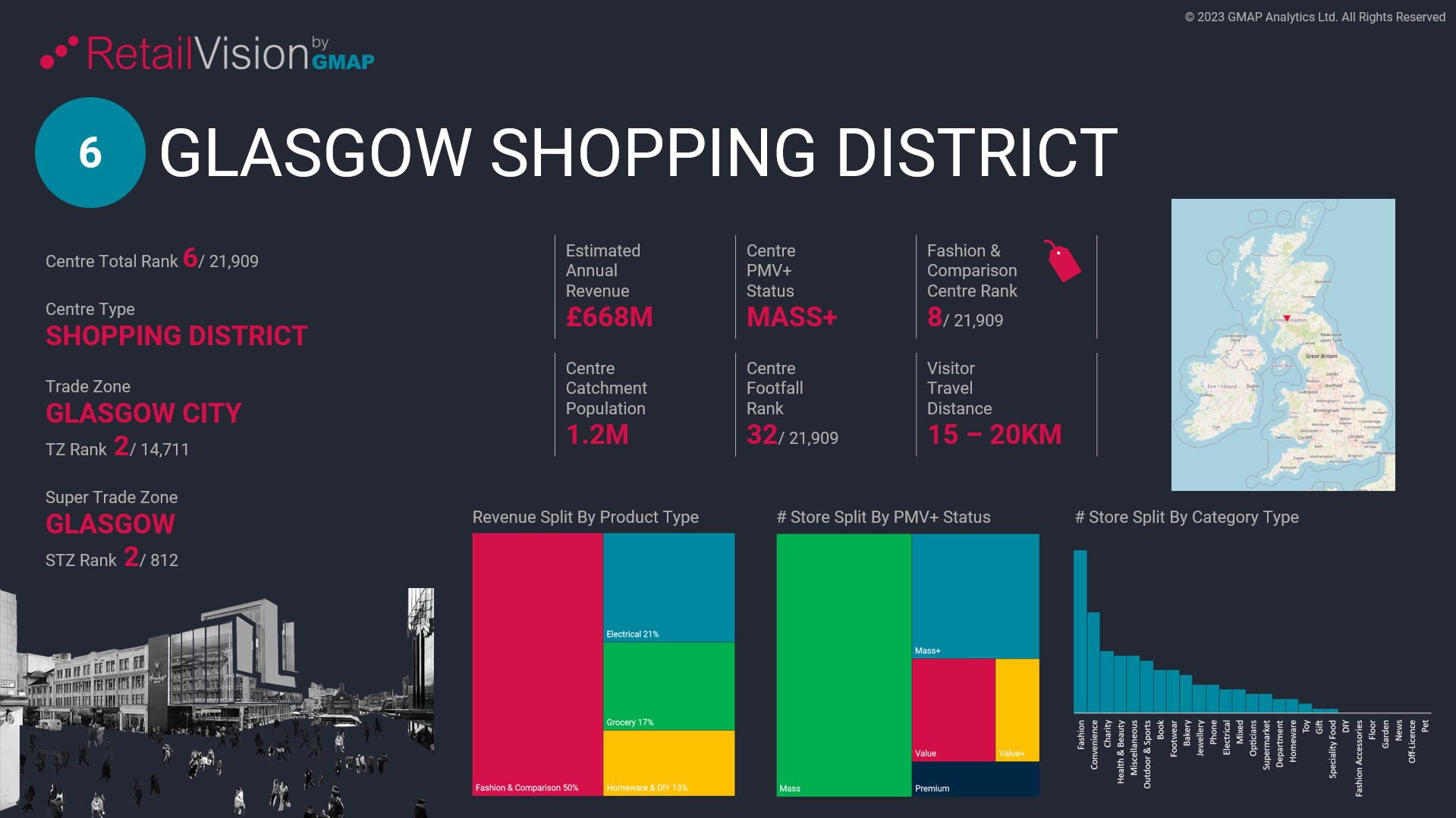

6th Top UK Retail Centre: Glasgow Shopping District

Going further north to Scotland, the Glasgow Shopping District is the 6th ranking Retail Centre, and 8th Fashion & Comparison Centre.

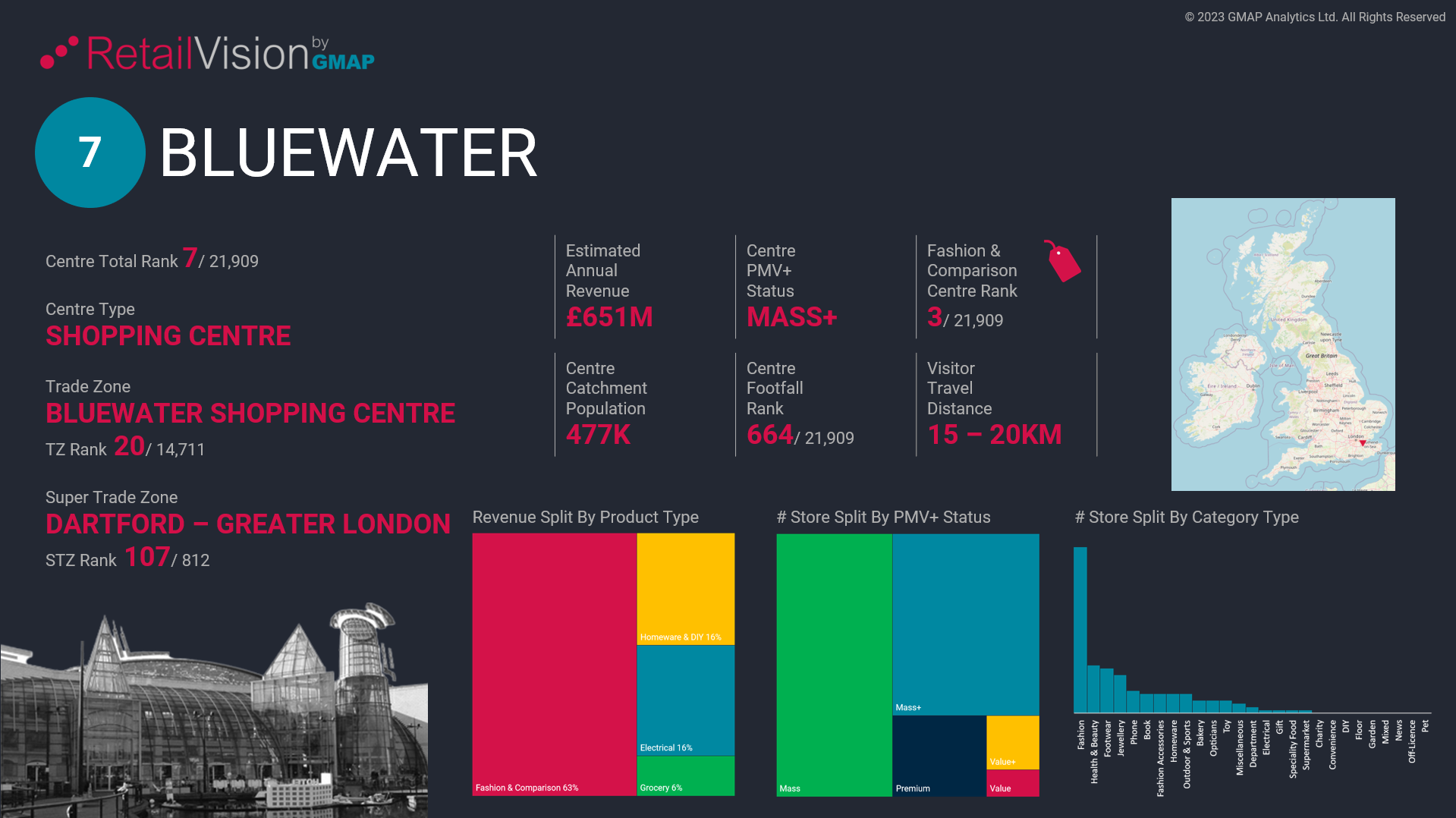

7th Top UK Retail Centre: Bluewater

Back down to the south of England, Bluewater is the 7th Retail Centre, and this out-of-town shopping destination also ranks 3rd for Fashion & Comparison with a high volume and revenue split for this product type!

8th Top UK Retail Centre: Liverpool One

Liverpool One, in the heart of Liverpool’s city centre, is the 8th top Retail Centre in the UK.

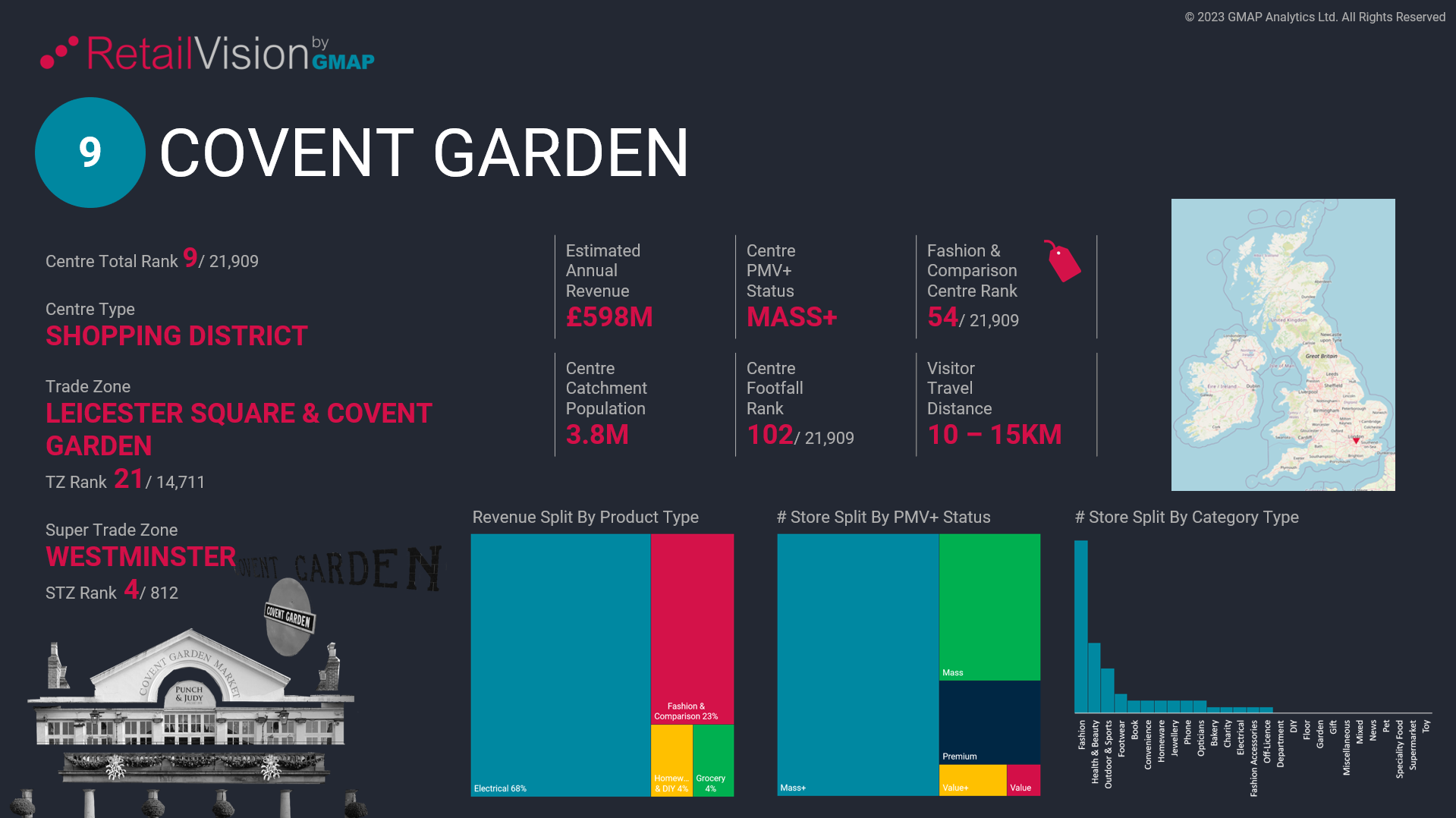

9th Top UK Retail Centre: Covent Garden

Another key London tourist destination ranks in the top 10: Covent Garden ranks 9th with a Revenue Estimate of £598M.

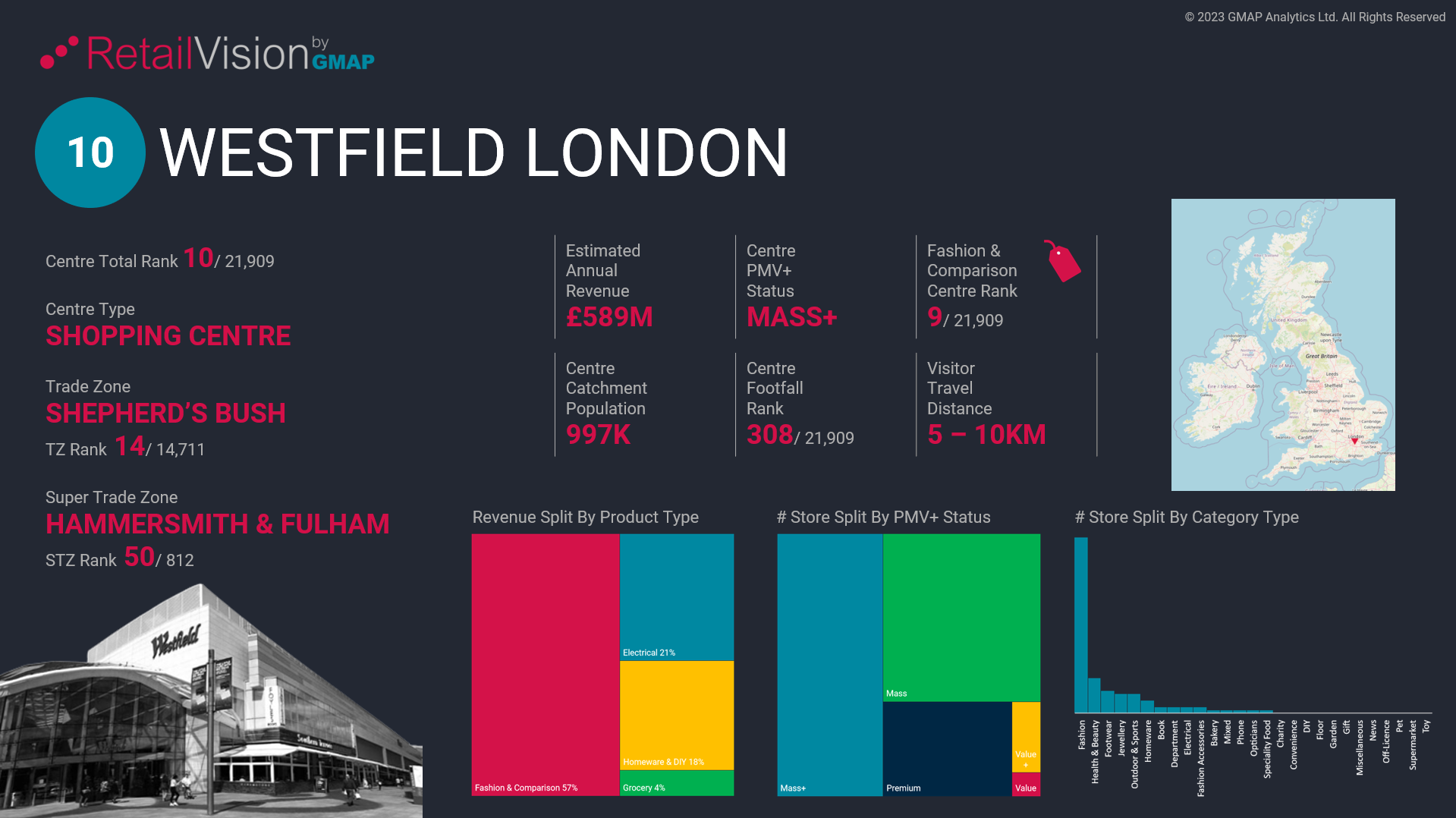

10th Top UK Retail Centre: Westfield London

Finally, in 10th place, we have the notorious Westfield London in Shepherd’s Bush!

What Do the Top 10 Retail Centres Have in Common?

The top 10 Retail Centres all had:

- A Revenue Estimate over £500M

- PMV+ Status of Mass+

- Ranks in the top 1% of Centres for Fashion & Comparison Revenue

- Centre Catchment Populations over 450K

- Fashion as the Category with the highest number of stores

What is RetailVision?

At GMAP, we specialise in providing objective ways to help clients across several sectors to make location planning decisions. This includes a host of data products

that provide location intelligence; including our RetailVision product.

RetailVision location intelligence data

provides stakeholders with a comprehensive depiction of the UK retail landscape. This includes store locations with coverage of over 80,000 stores for over 800 brands in 27 categories, and 21,000 Retail Centres. Retail Centres are then aggregated into 13,000 Trade Zones, and further grouped in 800 Super Trade Zones to allow for macro-level comparisons.

Location Intelligence with RetailVision

For each Retail Centre, a variety of attributes are available which can allow you to compare UK retail destinations:

- Each Retail Centre is classified by a Type, e.g. Arcade, Shopping District, Retail Park

- Centres are segmented into 5 Categories: Premium, Mass+, Mass, Value+, and Value

- Centre Revenues – GMAP’s model simulates Bricks & Mortar Spend, which estimates Retail Centre Revenue to each Retail Centre by 4 product types: Grocery, Fashion & Comparison, Homeware & DIY, and Electrical. Revenues of different Centres can then be compared, by total Centre Revenue or by product type. Centres are then Ranked by Revenue – which is how we established the top 10 Retail Centres in the UK!

- Quarterly Geomobility indexes can help you to see how Centre footfall varies across different Centres, as well across time.

- Centre Footfall Catchments allow you to understand the distance travelled to a Centre, and therefore its ‘attractiveness’, as well as the catchment population.

Such Location Intelligence can support you in your business decision making, such as in making Location Planning Decisions.

How Can RetailVision Support Your Location Planning Decisions?

RetailVision Insight can be used for:

- Retail Location Planning – develop comprehensive estate strategies, such as tactics for expansion or rationalisation.

- Monitoring market share performance – how is your brand operating compared to the rest of the market?

- Benchmarking competitor brands – what are the location strategies of your competitor or affinity brands compared to your own? E.g., what type of Retail Centres are they in?

- Site Feasibility Assessments - quantify and rank the size of the revenue opportunity of a Retail Centre when provided with lease opportunities from commercial property agents.

How Can GMAP Support Your Location Intelligence?

As well as RetailVision, GMAP hold other data products that can support your location intelligence. Some of these datasets include:

GMAP also provide location intelligence software tools that enable clients to conduct in-house spatial analysis. MVPLUS

is our off-the-shelf location intelligence tool and location planning software. In addition to this, we have experience building more bespoke location intelligence tools to suit individual clients. These solutions can often allow users to work with their own data or licensed datasets. They can cut, manipulate and overlay datasets and view them spatially on a map. If you are serious about location intelligence, finding and using the right tools is key.

Get In Touch

To learn about RetailVision, and how our location intelligence data and software could support you, get in touch at info@gmap.com!